Safeguarding Legal Interests: Understanding Legal Insurance Coverage

Legal insurance coverage stands as a crucial shield, offering individuals and businesses protection and support in navigating legal complexities.

Exploring Comprehensive Coverage

Legal insurance coverage encompasses a broad spectrum of legal services. From consultation fees, attorney representation, document preparation, and even court representation, this coverage provides a safety net for legal needs, ensuring access to necessary legal services without the hefty financial burden.

Legal insurance coverage as a Shield for Individuals

For individuals, legal insurance coverage offers peace of mind. It caters to various personal legal needs, including family law, estate planning, landlord-tenant disputes, and more. This coverage ensures that individuals have access to legal advice and representation when faced with legal challenges.

Businesses Fortified by Legal Protection

Businesses benefit immensely from legal insurance coverage. It shields them from the potential financial strain that legal disputes or issues could inflict. Coverage often extends to employment law matters, contract disputes, liability claims, and other legal challenges that businesses may encounter.

Tailored to Specific Needs

One of the merits of legal insurance coverage is its customization. Policies can be tailored to meet specific needs, whether for individuals or businesses. Coverage options vary based on requirements, ensuring that policyholders receive adequate support in areas they need most.

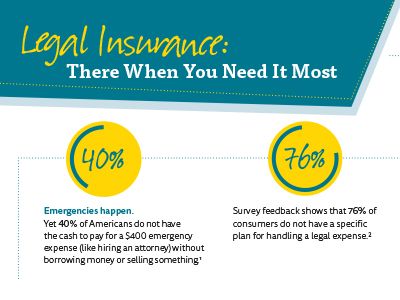

Affordability and Cost-Efficiency

Legal insurance coverage offers an affordable way to access legal services. With a modest premium, policyholders gain access to a wide array of legal assistance, preventing substantial legal costs that might arise without coverage.

Understanding Policy Limitations

Despite its advantages, legal insurance coverage may have limitations. Policies typically delineate covered legal matters and impose certain exclusions or limitations on coverage. It’s crucial for policyholders to understand these limitations to manage expectations effectively.

Partnering with Legal Professionals

Legal insurance coverage often collaborates with networks of legal professionals. Policyholders gain access to a pool of vetted attorneys or law firms, ensuring quality representation and expert advice when needed.

Prevention Through Legal Counsel

Beyond reactive legal support, legal insurance coverage emphasizes preventative measures. Many policies offer legal counsel services, enabling individuals and businesses to seek advice on legal matters before they escalate.

Evaluating Coverage Options

Choosing the right legal insurance coverage entails thorough evaluation. Policyholders should assess coverage details, compare offerings from different providers, and ensure that the policy aligns with their anticipated legal needs.

Embracing Legal Preparedness

Legal insurance coverage isn’t just about handling legal disputes; it’s about preparedness. It fosters a proactive approach to legal matters, encouraging individuals and businesses to address potential legal issues before they evolve into significant challenges.

In essence, legal insurance coverage serves as a robust safety net, ensuring that individuals and businesses have access to legal assistance and protection when needed most. Understanding the nuances of coverage, its benefits, and limitations allows policyholders to leverage this protection effectively.