Subheading: Transforming Financial Landscapes

Digital lending platforms have emerged as transformative forces in the financial landscape. These innovative platforms leverage technology to facilitate access to credit for individuals and businesses. With streamlined processes and user-friendly interfaces, they offer convenient solutions for borrowing and lending.

Subheading: The Evolution of Borrowing

Traditionally, obtaining a loan involved extensive paperwork, long waiting periods, and strict eligibility criteria. However, digital lending platforms have revolutionized this process. They provide quicker approvals, often within hours, and simplified documentation requirements. This accessibility has democratized lending, allowing a broader range of individuals to secure funds.

Subheading: Diverse Offerings and Flexibility

One of the notable features of digital lending platforms is their diverse range of offerings. They cater to various needs, from personal loans and small business financing to peer-to-peer lending and microloans. Furthermore, these platforms offer flexibility in terms of repayment schedules and interest rates, accommodating different financial situations.

Subheading: Harnessing Technology for Risk Assessment

Digital lending platforms utilize advanced algorithms and data analytics to assess borrowers’ creditworthiness. They analyze multiple data points, including financial history, transaction patterns, and even social media behavior, to determine the risk associated with lending to an individual or business. This data-driven approach enhances accuracy in decision-making.

Subheading: Addressing Financial Inclusion

One of the most significant impacts of digital lending platforms is their role in promoting financial inclusion. They reach underserved populations that may have limited access to traditional banking services. By providing opportunities for credit in previously overlooked segments, these platforms contribute to economic empowerment and growth.

Subheading: Regulatory Framework and Consumer Protection

As digital lending continues to expand, regulatory frameworks play a crucial role in ensuring consumer protection and maintaining market stability. Regulations govern aspects such as interest rate caps, transparency in lending terms, data privacy, and fair lending practices. Adhering to these regulations is paramount for the sustainable growth of these platforms.

Subheading: The Future Landscape

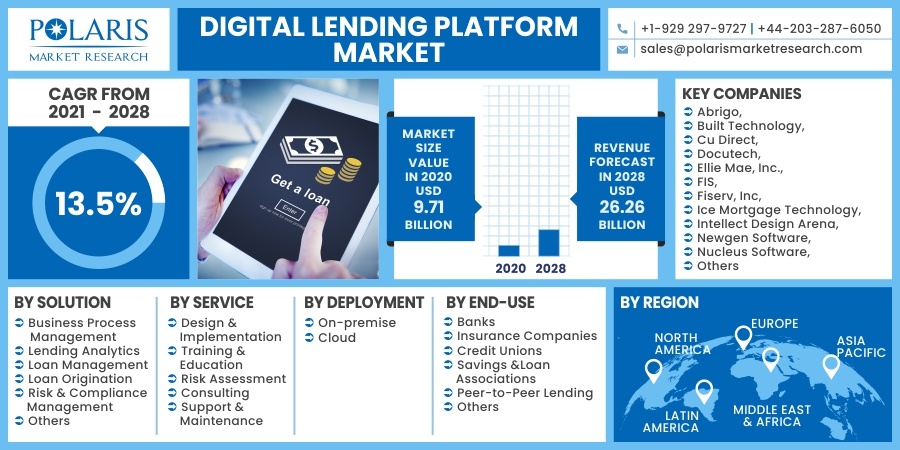

The future of digital lending platforms appears promising, marked by continuous innovation and evolution. Integrating technologies like blockchain for secure transactions and implementing machine learning for more precise risk assessments are among the anticipated advancements. Additionally, partnerships with traditional financial institutions may further strengthen their reach and impact.

Digital lending platforms play a pivotal role in reshaping the borrowing and lending landscape. As they continue to evolve, their ability to foster financial inclusion, streamline processes, and innovate in the financial sector remains a catalyst for positive change.

To learn more about the dynamic world of digital lending platforms, visit Digital lending platforms.